Resource and Project Management

Sage 100 Payroll

Home » ERP Resources » Sage 100 Resources » Sage 100 Payroll

Payroll*

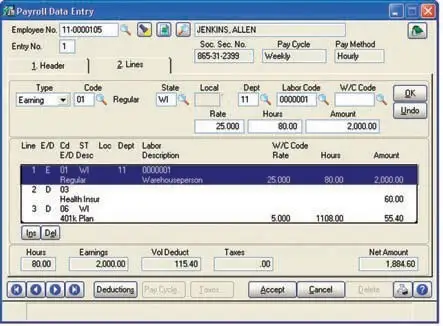

Use the flexible features and functionality of the Sage 100 ERP (formerly Sage ERP MAS 90 and 200) Payroll module to handle your payroll complexities and ensure you’re making the correct deductions when processing your employees’ payroll. Payroll makes in-house payroll preparation easy and efficient, providing you with the ability to process at a fraction of the cost and time of a manual payroll system or outside service bureau. In addition to simplifying in-house payroll preparation, Payroll reporting capabilities provide high-level, insightful business data regarding employee deployment and costs for more informed business decisions. Add the Direct Deposit module and reduce the time and cost of processing printed payroll checks and offer employees a convenient, secure alternative to getting their checks at work or in the mail.

Payroll automatically applies earnings and deductions, calculates employee and employer payroll taxes, and prints checks and vouchers complete with year-to-date earnings and tax information. All current federal and state tax tables are included, and updates are provided as an on-plan Business Care benefit. Quickly print quarterly and annual payroll reports and W-2 forms required by various tax authorities. Information flows through to Federal and State eFiling and Reporting, which enables you to e-file. When used with the Direct Deposit module, improve employee satisfaction while saving time, money, and the environment by going paperless. Also save the cost of printing, storing, and securing your preprinted check forms.

An important feature of the Sage 100 ERP Payroll module is its ability to process earnings for more than one tax jurisdiction (state or local) for each employee per pay period, produce a single paycheck, and retain the information for later disclosure on quarterly reports and W-2 statements. Extensive information is maintained for each employee, including date of birth, emergency contacts, review dates and comments, marital and tax status, year-to-date earnings, and deductions, as well as vacation, sick days, and other benefit accruals. And, of course, the Payroll module enjoys award-winning Sage customer and technical support.

*This module is compatible with Sage 100 Standard and Advanced ERP.

Edition

Compatible with Sage 100 Standard and Advanced ERP

Benefits

- Take the hassle out of processing payroll and deduction calculations

- Streamline your payroll data entry process

- Enhance security with in-house processing

- Process multistate and local taxes

- Track benefit accrual and 401(k) accounts

- File W-2 forms electronically† using Federal and State eFiling and Reporting

- Add Direct Deposit and save more time, money, and the environment

- Integrate with the Sage HRMS (formerly Sage Abra HRMS) module for more specialized tracking and planning of employee benefits

†Additional e-filing fees may apply.

Features

MULTIPLE DEPARTMENTS

MULTIPLE BANK ACCOUNTS

FEDERAL AND STATE TAXES

Facilitate filing payroll tax information with Federal and State eFiling and Reporting features—electronic forms automatically populate information in the appropriate fields to save time and reduce errors. Automatically e-file W-2s and 1099s, print and mail forms to your employees, or go completely green with our fee-based e-filing service. Current federal and state tax information is available online and updated quarterly. Local taxes can be added and tax tables can be modified.

SECURITY BY DEPARTMENT

MULTIPLE EARNINGS DISTRIBUTION

EARNINGS AND DEDUCTION INFORMATION TRACKING

DIRECT DEPOSIT MODULE (OPTIONAL)

Add the Direct Deposit module and generate entries, process your employee paychecks, and produce an Automated Clearing House (ACH) file to be routed to your specified financial institution. Your employees can view their information using the self-service viewer and choose to split disbursements between multiple accounts, such as savings and checking and different institutions based on fixed dollar amounts or percentages.

MANUAL CHECKS/CHECK REVERSAL

EFFICIENTLY PROCESS DEDUCTIONS

Automatically perform deductions utilizing Payroll Deduction Codes for 401(k) and Pension Plans, for regular, sick, and vacation earnings. Also make deductions using your choice of deduction methods, including setting deductions based on earnings type such as Based on Paid Hours, Pay Rate, Regular Plus Overtime, Percentage of Total Hours, and Percentage of Deduction Method. Deductions can be automatically recalculated based on changes in the earnings line during Payroll Date Entry.

BENEFIT ACCRUAL

MANAGEMENT AND TAX REPORTS

941 AND QUARTERLY PAY PERIOD RECAP REPORT

Want More Information on Resource and Project Management?

Lead your company to increased efficiency and profitability. Have a complete solution for fully supporting one of your most vital assets: Your employees.