Resource and Project Management

Sage 100 Electronic Reporting

Home » ERP Resources » Sage 100 Resources » Sage 100 Electronic Reporting

Electronic Reporting*

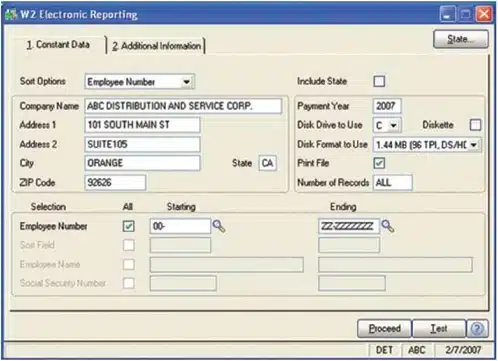

The Internal Revenue Service Government Regulations outline the procedure for submitting year-end W-2 and 1099 information on electronic media. According to these regulations, companies reporting 250 or more W-2 or 1099 forms must file this information using electronic media. The simple, easy-to-use Electronic Reporting module for the Sage 100 ERP (formerly Sage ERP MAS 90 and 200) system is designed to assist you in complying with these regulations.

The Electronic Reporting module provides the capabilities for reporting wage and payment information from the Payroll and Accounts Payable modules and 1099-INT, 1099-DIV, and 1099-MISC information and submit it electronically in the format required by the federal government.

Several states have also adopted electronic reporting regulations, using the federal reporting requirements as guidelines. Sage 100 ERP users who file W-2s for employees or 1099s for vendors who work or live in the states that comply with either the current federal MMREF-1 format or the TIB-4 format can file their state information using the Electronic Reporting module. This module, connects with the Payroll and Accounts Payable modules, to help you comply with tax regulations quickly and easily.

*This module is compatible with Sage 100 Standard and Advanced ERP.

The simple, easy-to use Electronic Reporting module is designed to assist you in submitting year-end W-2 and 1099 information and complying with regulations.

Edition

Compatible with Sage 100 Standard and Advanced ERP

Benefits

- Process payroll without the paper— save time, money, and the environment

- Increase efficiencies by electronically routing to the specified financial institution

- Reduce the risk of fraud and conform to NACHA standards

- Provide convenient payroll disbursements more quickly to your employees

- Allow your employees to allocate by percentage or amount to multiple accounts

Features

INTEGRATION WITH PAYROLL

STATE-SPECIFIC REPORTING

TEST RUNS

Some government agencies require you to submit a test file along with an application to file electronically. The Sage 100 ERP Electronic Reporting module provides test runs of federal and state W-2s and 1099s, giving you the ability to comply with this requirement.

About Sage

Sage is a leading global supplier of business management software and services for small and midsized businesses. The Sage Group plc, formed in 1981, was floated on the London Stock Exchange in 1989 and now employs more than 12,300 people and supports more than 6 million customers worldwide. For more information about Sage in North America, please visit the company website at www.SageNorthAmerica.com. Follow Sage North America on Facebook, https://www.facebook.com/SageNorthAmerica, and Twitter, https://twitter.com/#!/sagenamerica.

Want More Information on Resource and Project Management?

Lead your company to increased efficiency and profitability. Have a complete solution for fully supporting one of your most vital assets: Your employees.