The new Sage 100 Payroll 2.0 and up is a modernized version of the legacy module designed to deliver a better user interface, user experience and enhanced performance for your accounting and human resource teams while processing payroll. Sage has been working on revamping the payroll module in your ERP to improve the architecture and include the latest updates for compliance. Upgrade your payroll without having to upgrade your whole system.

Sage Payroll has been migrated from the legacy framework to the more modern Business Framework, allowing users access to new and improved features and capabilities. This also allows more seamless integration with your Sage 100 ERP, enabling you to more easily automate the transfer of files between your applications and build an efficient HR technology stack. With guidance and expertise delivered by SWK’s human capital management (HCM) team, your solution will provide the maximum ROI on your human resource management software.

UPDATED BATCH PROCESSING

- Multiple payroll runs in progress at the same time

- Each batch has its own pay cycle

- Multiple users can access the same batch at the same time in Payroll Data Entry

- Only one batch at a time can be accessed when running other Payroll tasks, including Payroll Tax Calculation, Check Printing, and Check Register/Update

- You CANNOT merge or renumber batches or transfer records from one batch to another

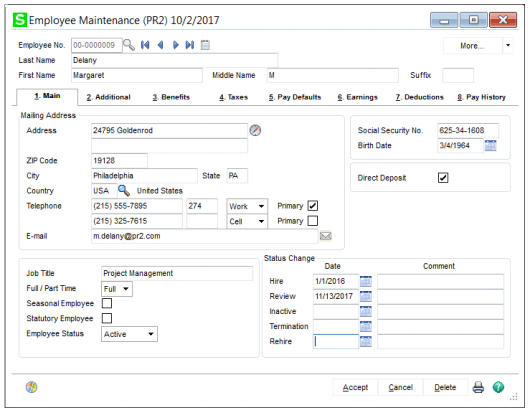

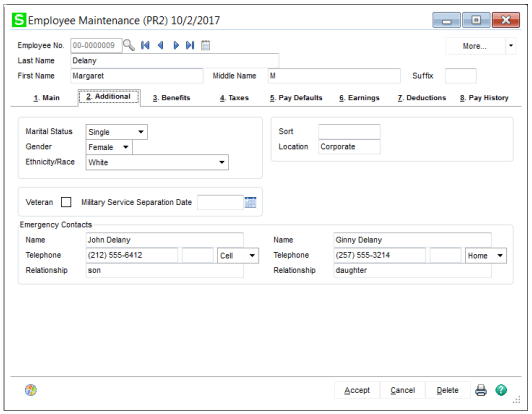

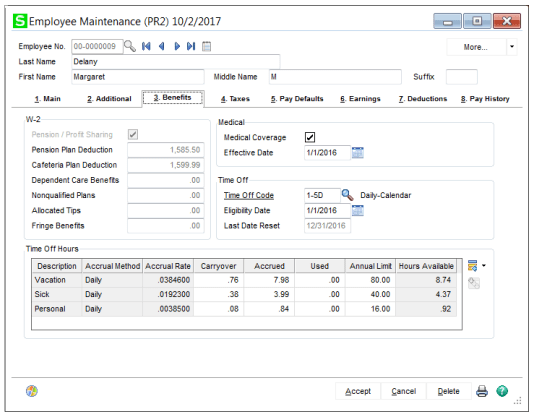

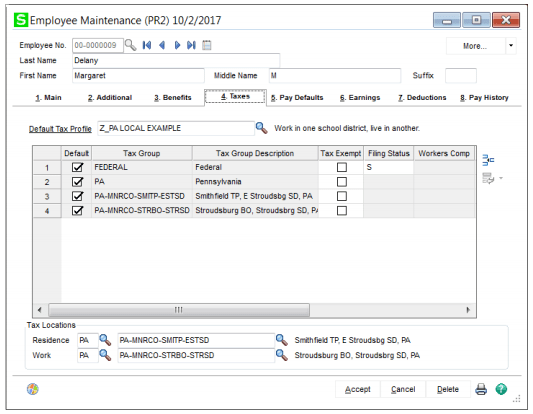

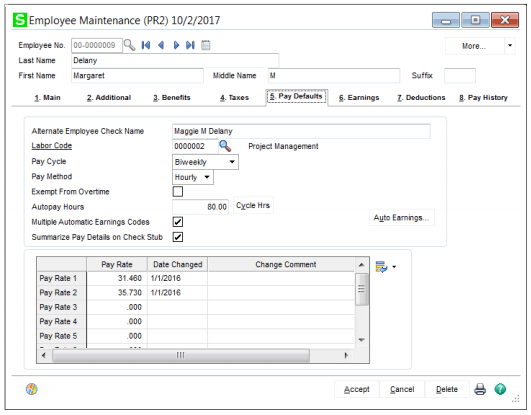

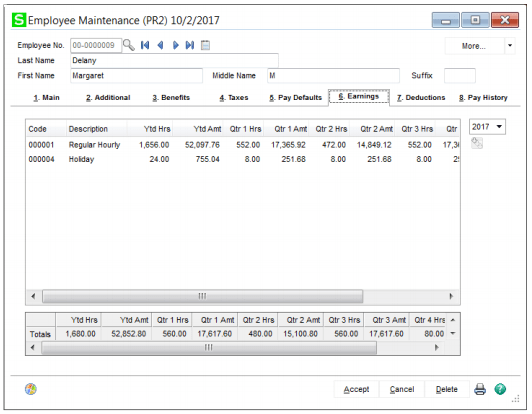

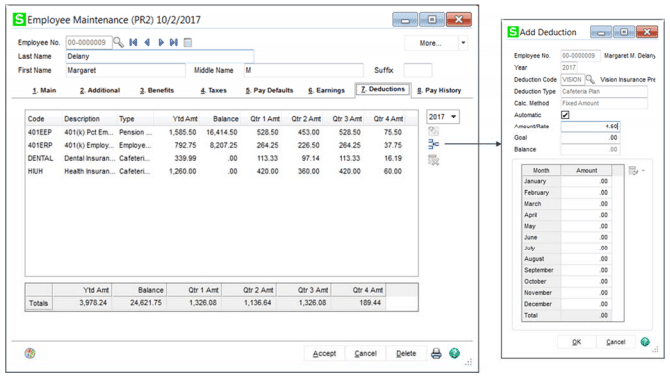

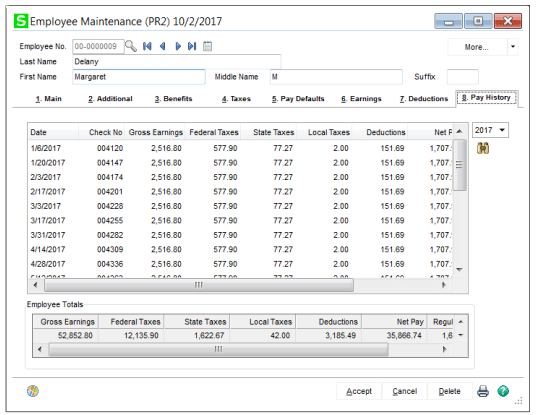

ENHANCED SCREENS

EXPANDED EARNING AND DEDUCTION CODES

- The Earnings and Deduction Code field has been expanded from 2 to 6 characters

- The Description fields for both have been expanded from 13 to 30 characters

- A new field, Apply to W-2 Box, has been added to Deduction Code Maintenance. Use this field to specify whether box 12 or box 14 on the W-2 form is used for the deduction

- A new check box, Apply to Box 14 on W-2, has been added to Earnings Code Maintenance. Select this check box to include the year-to-date earnings for the earnings code in Box 14 on W-2

- New Tax Rule Field

- The Subject to Federal Tax and Subject to State Tax sections have been removed and replaced with a Tax Rule field

- You must select a tax rule for each earnings code and certain deduction codes before processing payroll

IMPROVED DEPARTMENT SECURITY

- When setting up a list of users who can access a department, you must now enter users’ logon ID – previously the user code was entered

- If you’re upgrading and were using department security, you’ll need to recreate the list of users for each department

- You must have access to all departments in order to print the Check Register and the Employer Expense Summary.

- You must have access to all departments to access:

- Tax Profile Maintenance

- ACA Applicable Large Employer Report

- Period End Processing

- Periodic Time Off Accrual

- Federal and State Tax Reporting

BENEFIT ACCRUALS IS NOW TIME OFF

- Three user-defined time-off types have replaced the Vacation, Sick, and user-defined benefit types

- Vacation and Sick are the default names for the first two time-off types, but they can be changed

- The exact employee pay rate, with a decimal precision of 3, is printed on the Time Off Register and used to calculate the dollar value of the accrued time off. The calculated value is then rounded. In prior versions, the pay rate was rounded before it was used in the calculation.

REVAMPED PAY CYCLES

- The Check Date must now be entered on the Pay Cycle window. This date is used to calculate some payroll taxes. It is no longer on the Check Printing screen. If you change the date, you must rerun Payroll Tax Calculation.

- A Period Starting Date field has been added to the window. When you select a pay cycle and enter a period starting date, the ending date is automatically calculated, but you can change it. If you enter the period ending date without entering the starting date, the starting date is automatically calculated.

- You can no longer pay a combination of pay cycles in one check run. You will need to use the Batch function for this.

SWK Resource Library

Learn how to get the most out of your Sage HR and payroll software by visiting the SWK Sage HRMS Video & Resource Library. From reporting tutorials to benefits tips and tricks to our HRMS Bootcamp video series, SWK Technologies will provide you with the resources and education you need to streamline your HCM systems to your needs.

Click here to view the Sage HRMS & Payroll Resource Library.

Sage 100 Payroll Tax Management

Tax Profiles

- In Tax Profile Maintenance is located on the Payroll Setup menu and you can create tax profiles that consist of one or more tax locations and their associated tax groups

- You can view a list of taxes included for each tax group and specify whether each tax should be calculated for employees to whom the tax profile is assigned

- Tax profiles are system-wide, so it’s not necessary to set them up more than once for multiple companies

- To use Tax Profile Maintenance, you must have access to all of the companies set up in your Sage 100 system

- If you are using payroll departments, you must have access to all departments to access Tax Profile Maintenance

Company Tax Group

- Company Tax Group Setup is located on the Payroll Setup menu and is used to maintain the following for each tax group:

- The tax ID number

- The general ledger account numbers for each type of tax

- Any tax rates (SUTA, FUTA) that are specific to your company are not maintained in the tax calculation engine.

- The Company Tax Group Setup records are company-specific, so you can set up separate tax IDs, accounts, and tax rates for each company.

Tax Rules

- You must select a tax rule for all earnings codes and for pension and cafeteria plan deduction codes to determine how the earnings and deductions affect tax calculations

- Tax rules are not company-specific.

- Tax rules for dependent care and nonqualified benefit plans mean that it is no longer necessary to manually enter the annual totals for these plans at year end

- You must select a tax rule for each earning code, pension or cafeteria plan deduction before processing payroll