In this article, we will walk you through how to survive a sales tax audit with Avalara tax automation software and the support of SWK Technologies. This web-based solution streamlines your compliance management by enabling digital collection, recordkeeping and reconciliation with the latest features hosted in the cloud. Integrating this application with your ERP will allow you to capture your transaction data in real-time and process your remittance without having to go through endless piles of paperwork.

In November 2020, SWK Technologies hosted a webinar featuring Avalara and one of our manufacturing customers using Sage software – Arlen Ness Motorcycles. Connecting the sales tax automation solution with their Sage 100cloud system, the manufacturer was able to completely restructure how they remitted sales and use tax for regulatory reporting. Using their story as a use case, we will show you how to best leverage this software to modernize your compliance and prevent tax collection from cutting into your business’s ROI.

Here are three best practices that will help you survive a sales tax audit when used with Avalara:

1. Keeping Track of Economic Nexus with Avalara

Economic nexus occurs when a business based in one state generates one or more interstate sales that reach past a certain threshold. The Supreme Court case, South Dakota v. Wayfair, Inc., overturned previous legal precedent that established a physical presence was required to collect sales and use tax from a customer in another state. The decision was influenced primarily (if not solely) on the impact technology has had on traditional commerce, namely how digital channels have expanded consumer access to remote sellers.

Nexus Risk Assessment – Not Limited to Ecommerce

Although the original focal point of burgeoning state tax nexus laws was the rise of ecommerce portals, the regulation has evolved along with the state of the omnichannel. Even if your sale was not a digital purchase, you must still collect and remit tax if you extend past a certain threshold of either a dollar amount or of sales made when it comes your interstate transactions. These ceilings vary, sometimes significantly, between each state and determining whether or not you have a nexus burden entails assessing risk in every state you have done business in.

Be Prepared for Regulatory Changes

Adding to the complexity of the multistate variations in tax nexus is the rate at which changes have occurred and continue to occur. The COVID-19 pandemic prompted many new policies and adjustments to existing ones, yet even without the coronavirus disruptions there have been quite a few states that have had to modify their requirements. As your economic nexus obligation can be subject to future revisions in more than one state, your business must be able to proactively keep track of regulatory amendments in addition to managing the existing statutes.

Nexus Makes Manufacturers a Target of a Sales Tax Audit

Manufacturing is one of the top industries targeted for sales tax audits, due in large part to how nexus affects their distributed value chains across state and county lines. Before Avalara, Arlen Ness Motorcycles was having a hard time trying to uncover and manage all the varying tax rule differences between their home state of California and their customers in 12 other states. Many other manufacturers and distributors are in the same boat as Arlen was and are forced to carefully review their out of state business relationships to measure nexus risk.

2. Utilize Sales Tax Compliance Automation for Collection

Automating your sales and use tax collection and reporting will enable you to consolidate the myriad of new filings economic nexus introduces to your interstate business. Leveraging Avalara to calculate rates and identify exemptions will ensure you will maintain accuracy in your compliance activities and reduce the time it takes to collect on each transaction. Taking advantage of digital technology will allow you to remove the pain points associated with traditional sales tax processes, permitting you to refocus operations on value generation.

Reconcile Human Error in Tax Reporting

Software automation provides you with increased opportunity to mitigate human error in data entry and management, streamline reconciliation and prevent inaccuracies from impacting an audit. Migrating your tax collection and reporting to more digitized systems will ensure that your finance team will have the right information for each transaction to maintain compliance.

Integrate Avalara with Your ERP and Sales Data

Integrating Avalara with your ERP will allow you seamlessly bridge your financial data and sales tax processes, empowering users to review transactions more quickly and easily through connected dashboards. Arlen Ness Motorcycles was able to do this by linking their new tax automation solution with their Sage 100 implementation, as well as with their ecommerce portal through Shopify.

3. Streamline Exemption Certificate Management to Avoid Audits

Exemption certificates are one of the hardest requirements to track and manage with the arrival of widespread economic nexus, yet this need is easy to overlook in favor of tax rate shifts. Avalara helps with much more than your calculations – it keeps you informed and updated on which of your transactions will be exempt from sales tax. This ensures that you will not violate compliance by misconstruing where exemptions apply, or risk your customer relationships by charging tax where it is not required.

Deploy Automation Faster with the Cloud

Leveraging the cloud will allow you to capture and migrate data in real-time, stay up to date on the latest regulations, and consolidate the operational touchpoints needed for process execution. With SaaS connectivity, Avalara not only delivers a faster implementation and deployment pace, but it also enables you to stay in constant contact with your stakeholder channels.

Keep Stakeholders Engaged with Streamlined Communication

The complexity of tax reporting can impact your internal business units as well as external partners and customers, and it is equally important to provide the appropriate visibility to all parties. Your accounting and sales team need to stay informed of the right exemptions to apply to which client, as do the latter themselves to ensure collection and reporting remain accurate.

How Avalara Helps You Automate Sales Tax

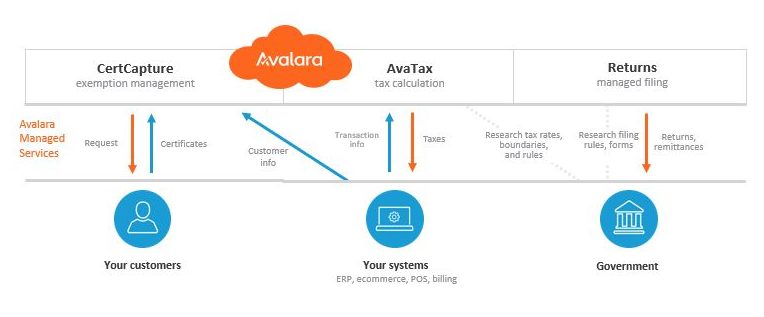

Avalara provides a seamlessly integrated sales tax collection and reporting workflow that leverages software automation and service by industry experts. Here are the primary modules that have allowed Arlen Ness Motorcycles and many other businesses to streamline their tax compliance:

- CertCapture – Avalara CertCapture helps you better manage your exemption certificates and automatically keeps your customers up to date on their certificate lifecycle

- AvaTax – Connected through the cloud, AvaTax reviews and calculates tax rates for your transactions based on every associated touchpoint of data including geographic, updated regulations, etc.

- Returns – The Avalara Returns module streamlines your tax return preparation and filing, informing you of any liabilities and submitting your payments to the right jurisdiction.

These solutions all work in tandem and utilize the data in the other modules as well as your ERP system to ensure your information is accurate and up to date.

Watch the Webinar to Discover More Ways Arlen Ness Uses Avalara

These are only a few of the ways that Arlen Ness Motorcycles was able to utilize Avalara to fulfill best practices for tracking economic nexus, automating compliance and managing exemption certificates for their sales taxes. To discover how else to leverage this tax automation system to alleviate your collection and reporting pain points, watch Arlen Ness’s story for yourself below.

Watch SWK’s on-demand webinar to hear directly from the CFO of Arlen Ness Motorcycles and uncover more benefits of Avalara for surviving a sales tax audit.