Rimee Jain

Sage Intacct Consultant

SWK Technologies, Inc.

Sage Intacct has several features that allow you to automate processing, tracking and reporting for various taxation methods, including purchase use tax. This walkthrough will show you how to set up, configure and leverage the sales and use tax functionality in your Sage accounting software when making purchases from across U.S. states, including those with different taxation rules:

What is Purchase Use Tax?

Use tax is a tax you pay when you buy something without paying sales tax — usually from another state or online. Companies typically encounter this scenario when purchasing from vendors in other states that do not collect sales tax on behalf of the buyer’s state. It makes sure you still pay tax even if the seller didn’t charge it.

Where Does It Apply?

Use tax is mostly used in the United States. Every U.S. state that has a sales tax also has a use tax — this includes states like California, Texas, New York, Florida, etc.

When Do You Need to Pay Use Tax?

- You buy something online and the seller didn’t charge sales tax.

- You buy from a business in another state that didn’t charge your state’s tax.

- You bring something into your state from somewhere else and didn’t pay enough tax.

Purchase Use Tax Example:

You live in New York and buy a $500 chair online from a store in Oregon (which has no sales tax). Since you didn’t pay sales tax, you must pay use tax to New York on that $500.

How Do You Pay It?

– People usually pay it when filing state income taxes.

– Businesses report it in their regular sales tax returns.

Remember:

– Use tax is usually the same rate as your state’s sales tax.

– It helps stop people from avoiding taxes by buying from places that don’t collect it.

Sage Intacct Purchase Use Tax – Demo

The following scenario demonstrates an example of managing purchase use tax functionality in Sage Intacct for transactions made online or across state lines.

This scenario is based off a purchase in Oregon (which has no sales tax), and then use of that purchase in California, where the company would be required to pay the CA sales tax as if they had purchased in California originally. Most use tax scenarios will be similar to this concept.

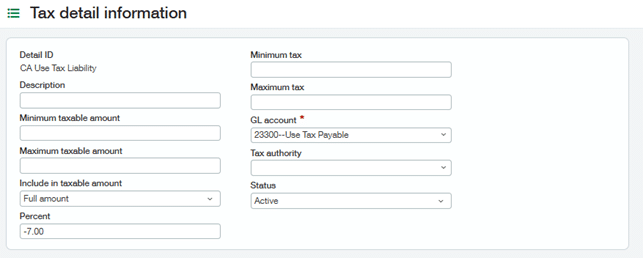

First, set up two tax details. One will represent the tax liability you will accrue for the use tax you need to pay to the tax authority. Note that the tax percentage should be entered as a negative, and the GL account should be your use tax liability accrual account.

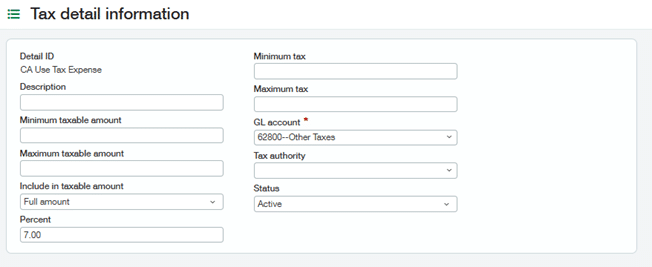

Set up another tax detail to capture the tax expense incurred due to the use tax. It should be for the same percentage but use a positive number. The GL account should be the appropriate tax expense account.

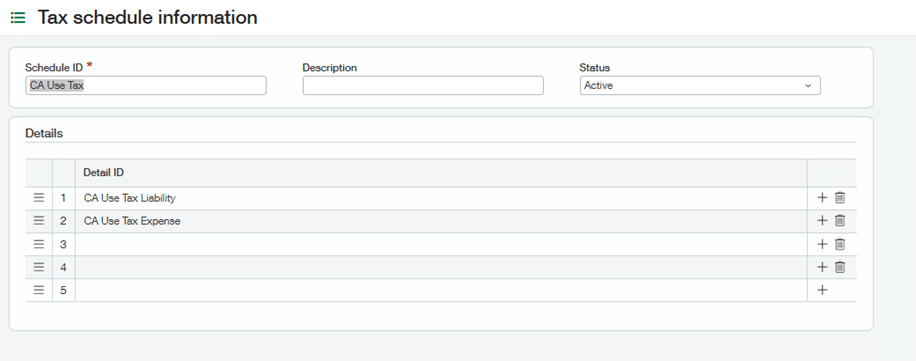

Next, set up a Tax Schedule that combines both of these tax details together to represent the use tax you will apply to your Purchasing transactions.

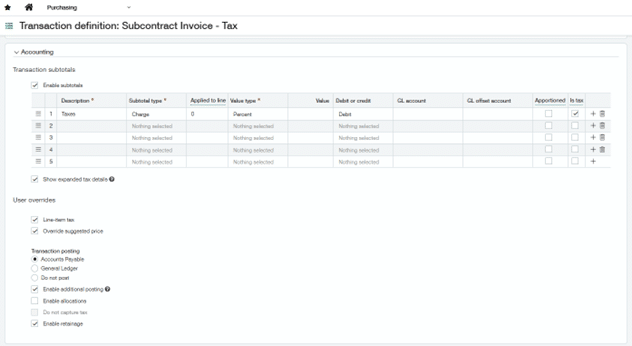

On your Transaction Definition, ensure that your subtotals are configured to capture tax correctly. Ensure your tax subtotal is configured as a charge, with value type of percent, and set to ‘debit. Mark ‘Is tax’ as true.

Ensure your Items are taxable and have been assigned an Item tax group, your vendor’s are taxable and have been assigned a Contact tax group, and you may need at least one tax mapping to be configured. If you are using the new Override tax schedule feature then additional tax mappings are somewhat optional since the tax schedule can be manually assigned to lines during document entry.

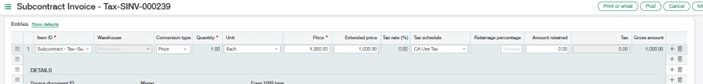

When entering a document where an entry requires the tracking of use tax, assign the Use tax schedule as appropriate. Note the two tax rates will calculate offsetting tax amounts. This ensures the value of the line doesn’t change, but enables the system to generate the appropriate tax entries.

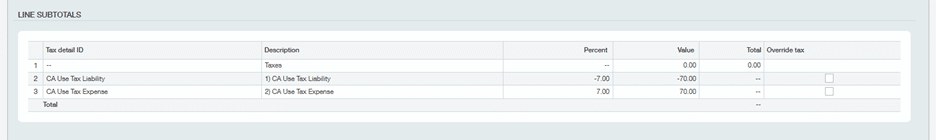

Here is a screenshot of the document showing the subtotals calculating in this example:

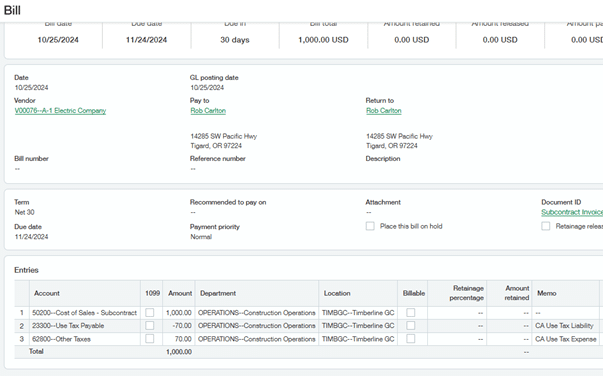

When posted from Purchasing to AP and GL, the AP bill appears as follows:

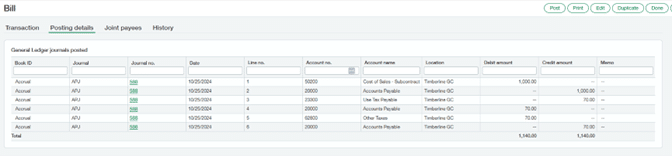

You can see the GL posting:

- The original 1000 posts as a debit to the cost of sales and a credit to accounts payable as expected.

- A 70 credit posts to the use tax liability representing the amount owed to the tax authority

- A 70 debit posts to the tax expense account representing the expense you have incurred for this tax.

- There are offsetting debits and credits to accounts payable for the $70 tax amount.

Additional Sage Intacct Tax Capabilities

Sage Intacct’s tax management system supports multi-entity scenarios and can integrate with third-party tax calculation services like Avalara for automated tax rate updates and enhanced compliance features. For businesses operating across multiple jurisdictions, the system can also handle various tax scenarios beyond basic use tax, including global tax compliance requirements. You can also utilize Sage Intacct’s reporting capabilities to generate use tax summaries for filing state tax returns and maintaining audit trails for compliance purposes.

Learn More About Sage Intacct with SWK Technologies

SWK Technologies will help you gain the best value out of your software investment and ensure your integrations align with your business goals. Whether you are looking to integrate with other critical applications, streamline and enhance your reporting, or speed up a routine process, we have the expertise to guide you through the process.

Contact SWK today to see more of Sage Intacct firsthand and discover how this modern cloud accounting system will help you streamline your operations.