The Acumatica Cash Management module (also called Banking) serves as the central hub for managing transactions, credit card accounts and bank account feeds within your ERP. Connecting to your General Ledger (GL) as well as other payment modules like Accounts Payable, the integrated workflows here allow your team to seamlessly bridge the gap between your financial workflows and reporting, capture improved visibility into your cash flow.

Drawing on the training resources provided by SWK Technologies for our customers as well as documentation from Acumatica, this training guide delivers an in-depth look at what you can do in the Cash Management and grants you the information you need to get most out of your ERP workflows:

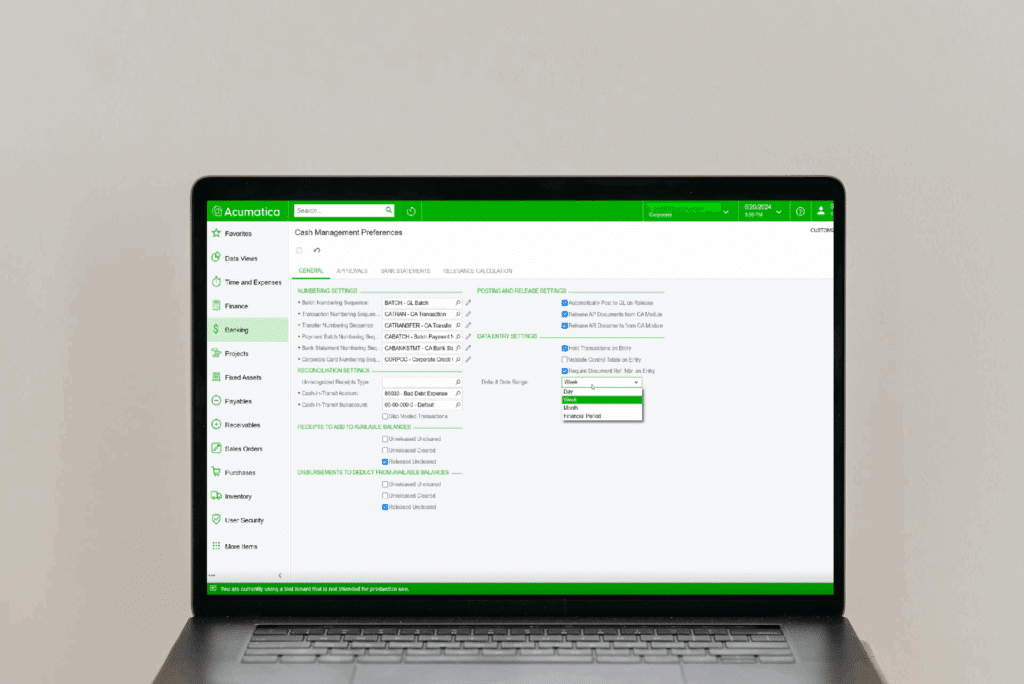

Preferences Configuration

Auto-Matching Optimization

One of the important configuration changes involves adjusting auto-matching timeframes. The system defaults to a five-day window for both receipts and disbursements, but this rarely reflects actual banking timelines.

Key Configuration:

- Disbursements: Extend from 5 to 30+ days

- Receipts: Keep at 5 days (deposits typically clear faster)

This adjustment improves auto-matching effectiveness since most checks do not clear within five days of issuance. If you leave the default settings, you may find your auto-matching functionality underperforms, requiring more manual reconciliation work.

The auto-matching processes in Acumatica use relevance calculations based on multiple factors including reference numbers, dates, payees and amounts. The system assigns weights to each factor, allowing you to fine-tune matching criteria based on the quality of data your bank provides.

Available Balance Settings

The “receipts to add to available balances” and “disbursements to deduct from available balances” settings control what appears in cash projection reports. These settings determine whether unreleased transactions impact your available balance calculations.

Best Practice: Check only “released” items for both receipts and disbursements. Unreleased transactions have not actually moved money in or out of bank accounts yet, so including them in available balance calculations can create misleading cash position reports.

Control Mechanisms

Enable “validate control totals on entry” when additional verification is needed. This requires users to enter the grand total of a batch before releasing it, serving as a double-check mechanism. While some organizations prefer this added security, others find it redundant since users are already entering the transaction amounts.

Payment Methods

Multi-Method Approach

Rather than trying to use generic payment methods for multiple purposes, create specific payment methods for different scenarios:

- Standard Checks: For regular AP payments

- Electronic Payments: For vendors paid through online banking (not file-based ACH)

- Wire Transfers: For high-value or international payments

- ACH Files: Only if you’re creating files for bank upload

Important Note: If you are not generating ACH files for bank upload, do not use the standard “ACH” payment method. Instead, create a custom “Electronic Payment” method to avoid confusion and unnecessary setup requirements.

Check Printing Configuration

Configure the remittance report settings to handle checks with more than 10 invoice lines. Without proper setup, the system will void the next check when line limits are exceeded. Instead, configure it to print a separate remittance report that can be sent with the check.

Credit Card Processing Integration

If you accept credit cards, you can configure processing centers to associate customer payment methods with specific processing companies. This enables automated credit card processing through the Accounts Receivable module while maintaining proper cash management integration.

Multi-Account Operations

If you have complex banking structures (such as concentration accounts that fund multiple subsidiary accounts), you can configure the system to handle these relationships. Set up payment methods without defaults to force selection of the appropriate account for each transaction.

Cash Account and Entry Type

Account Setup

- Naming Convention: Match cash account numbers to general ledger account numbers. This creates immediate clarity about which GL account each cash account represents, though it is not required by Acumatica.

- Branch Considerations: Use the “restrict visibility within branch” setting only when necessary. This can limit flexibility if you need to process transactions across different branches.

Entry Types

Pre-configure entry types for common transactions:

- Bank fees

- Interest income

- Service charges

- Transfer fees

Entry types streamline transaction entry by pre-populating GL accounts and descriptions. They must be set up at the system level first, then assigned to specific cash accounts where they will be used.

Branch-Specific Cash Management

If you operate multiple branches, each branch maintains its own cash accounts while working within a unified chart of accounts. Cash accounts are defined separately and linked to specific general ledger accounts, allowing branch-specific access controls while maintaining centralized reporting capabilities.

Bank Integration and Automation

Bank Feed Implementation

Acumatica supports multiple file formats for bank transaction import:

- OFX (preferred): Talks directly to Acumatica with proper field formatting

- CSV: Requires manual field mapping

- QBO/QFX: Requires some manipulation but widely supported

- Excel: For manual uploads when other formats aren’t available

Implementation Tip: Bank feeds are often included in Acumatica licenses (typically 5-10 accounts), making them cost-effective for many implementations. Start with one account to test connectivity and processes before expanding.

Acumatica can handle multiple bank statements from the same account or different accounts, provided transaction periods are in chronological order and do not overlap to avoid duplicates.

Transaction Rules for Recurring Items

Set up transaction rules for recurring monthly charges like bank fees. When the system recognizes specific text in transaction descriptions, it can automatically create the appropriate journal entries using predefined entry types.

Mass Processing

For high-volume operations, handle large numbers of transactions efficiently through mass processing features. This includes the ability to release multiple cash transactions simultaneously and process imported bank transactions in batches.

Note: These features are most beneficial for operations processing hundreds of transactions per period.

Bank Feed Connectivity Troubleshooting

Different banks use different service providers (Plaid, MX, etc.). If connectivity issues arise, work with your bank to identify the correct service provider and connection parameters.

The Deposit Process

Understanding the AR-First Methodology

Acumatica requires a different approach to deposit processing than many traditional systems. The workflow must be:

- Process AR payments first (customer pays invoice)

- Create bank deposit (money goes to bank)

This differs from cash-first approaches where you might record bank deposits before applying payments to invoices.

Why This Matters: Acumatica uses clearing accounts to bridge the gap between receiving payment and depositing it. When you process an AR payment, the system debits a clearing account and credits accounts receivable. The bank deposit then debits cash and credits the clearing account, completing the cycle.

Handling Deposit Variances

Real-world deposits often differ from invoice amounts due to processing fees. Use the charges tab in the deposit screen to account for:

- Credit card processing fees

- Bank service charges

- Currency conversion costs

This ensures your deposit amount matches what actually hits the bank account, enabling proper auto-matching during reconciliation.

Managing Problem Deposits

When deposits need to be reversed (bounced checks, processing errors), use the void function to reverse the transaction properly. However, this only affects the cash and clearing accounts – you will still need to reverse the original AR payment to reopen the customer invoice.

Unknown Payment Handling

For transactions that appear on bank statements but cannot be immediately identified (unknown customers or vendors), Acumatica provides an “unknown payments account” functionality. These transactions can be temporarily recorded as cash transactions using special entry types, then reclassified as proper payments once details become available. This maintains accurate cash positions while allowing time for research and proper classification.

Note: This feature is particularly useful for high-volume operations or when processing transactions from multiple sources.

Reporting Features

Cash Flow Forecasting

The system generates cash flow forecasts based on:

- Due dates on AP invoices (money going out)

- Due dates on AR invoices (money coming in)

- Manual forecast entries for planned transactions

You can add anticipated large purchases or other planned transactions that aren’t yet in the system to improve forecast accuracy. The forecasting functionality typically covers 30-day periods and can be performed in multiple currencies for international operations.

Multicurrency Operations

For international operations, Acumatica provides multicurrency cash management capabilities:

- Maintain cash accounts in different currencies

- Execute automatic cash revaluation to reflect exchange rate changes

- Calculate realized gains and losses when transferring funds between accounts with different currencies

- Use special multicurrency cash-in-transit accounts for inter-currency transfers

- View amounts in either the denomination currency or base currency

Note: These features require multicurrency support to be activated in your Acumatica ERP

Funds Transfer Management

For organizations with multiple bank accounts, the funds transfer feature handles inter-account movements. The system can also account for transfer fees within the same transaction, avoiding the need for separate journal entries.

Security and Access Control

If you need to limit access to sensitive cash account information, implement restriction groups to control which users can view specific accounts or balances. The system maintains complete audit trails of all cash-related transactions, including user IDs for each transaction or adjustment.

Note: Access control features are most relevant for larger organizations or those with specific compliance requirements

Key Reports

- Undeposited Payments Report: Shows AR payments that have been processed but not yet deposited. This report is crucial for organizations transitioning to the AR-first methodology.

- Cash Account Registers: Provide detailed transaction histories for reconciliation and audit purposes.

- Customizable Cash Reports: Start with high-level summaries and drill down to transaction details for comprehensive cash analysis and forecasting.

Petty Cash Management

Beyond bank accounts, Acumatica manages petty cash accounts. The Cash Account Details form allows you to monitor petty cash balances, view transaction history for specific date ranges, and switch between detailed and daily summary views. The system tracks both book balances and cleared balances, enabling proper reconciliation.

Transaction Approvals

For enhanced internal controls, you can configure approval workflows for cash transactions. When users attempt to release cash transactions requiring approval, the system changes the status to “Pending Approval” and routes them to authorized approvers.

Note: This feature is typically used by operations with formal approval processes or regulatory requirements.

Period Closing

The Cash Management module can be closed independently of other modules. This prevents backdated transactions while still allowing adjustments through the general ledger if necessary (with appropriate permissions).

Discover More Tips, Tricks and Other Features for Acumatica

SWK Technologies will help you get the most out of your ERP investment, leveraging our deep technological and industry knowledge as a top Acumatica VAR partner and Community resource. Check out some of our Acumatica videos and other educational resources, and reach out to us when you are ready to learn more tips and tricks to maximize your value return on your software.

Contact SWK here to gain access to more Acumatica tips, tricks, updates, and tailored demos.